February 17, 2026

Few topics generate as much concern around vehicle-to-grid (V2G) as battery health. For all the promise of bidirectional charging, grid flexibility, resilience, and new revenue streams, one question persists: What does this do to the battery?

It is a fair question. EV batteries are capital-intensive assets designed first and foremost to deliver mobility. Most drivers still see them as vehicles rather than grid assets. Asking owners to use their batteries for additional services naturally raises concerns about wear, warranties, and long-term value.

The good news is that the conversation has matured. We now have a growing body of experimental evidence, field data from pilots, and more sophisticated modeling that help distinguish real risks from outdated assumptions. At the same time, battery technology itself is evolving rapidly, which is beginning to reshape how degradation should be understood in bidirectional applications.

This article examines what we know today, where uncertainty remains, and why the technology trajectory matters for V2G’s future.

Why Battery Degradation Became the Central Concern

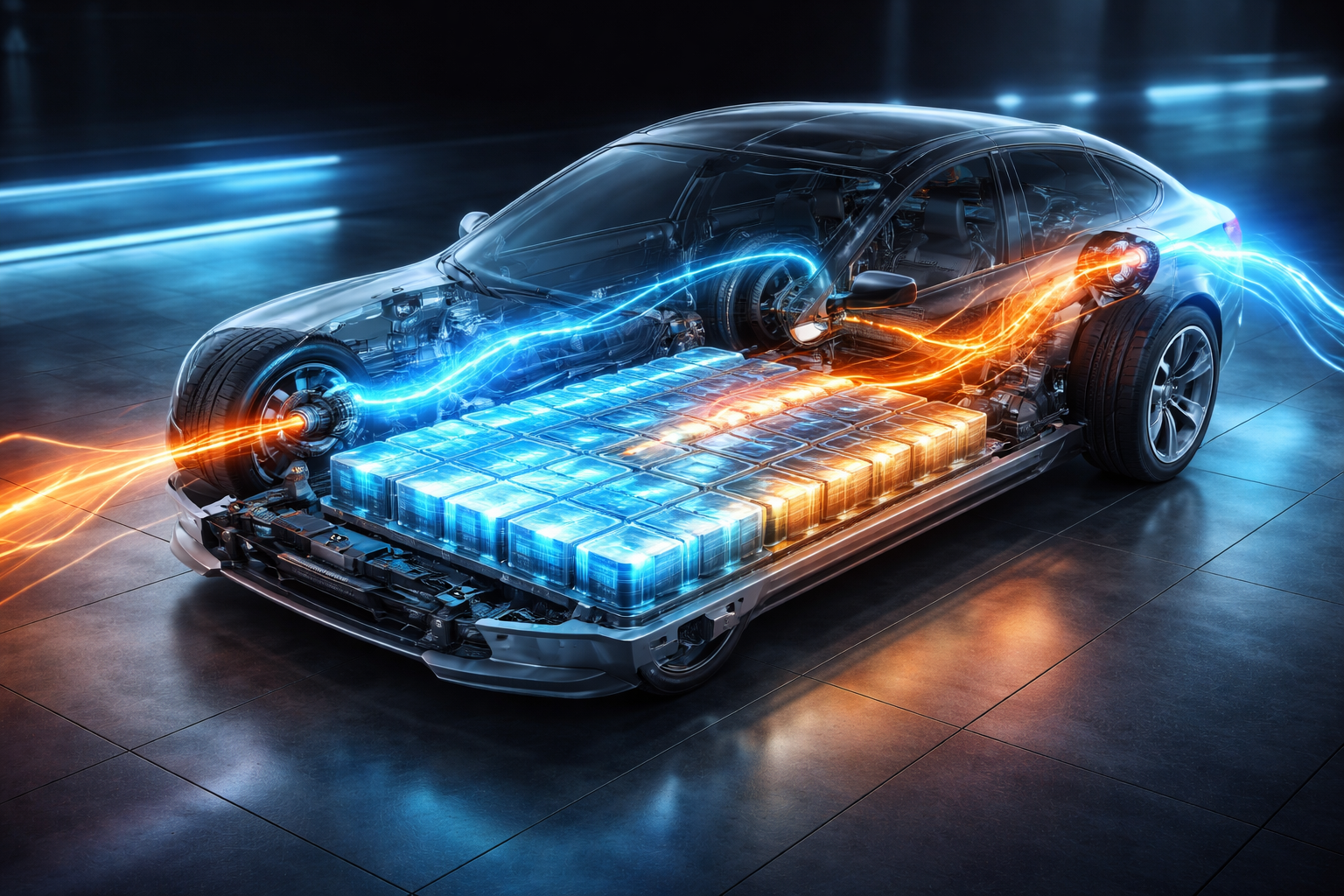

Battery degradation is inherent to all EV operations. Lithium-ion batteries gradually lose capacity over time due to calendar aging and cycling. Energy flows into the battery during charging and flows out to power the electric motor during driving.

What V2G introduces is additional, controlled discharge, exporting energy to a home, building, or the grid when there is economic or system value in doing so.

Early critiques of V2G often assumed worst-case conditions: deep discharges, high power swings, and frequent cycling layered on top of daily driving. Under those assumptions, accelerated wear appeared inevitable.

Large-scale, long-duration V2G programs remain limited. However, pilot deployments and laboratory simulations consistently use operating strategies that confine cycling to narrow state-of-charge windows, avoid deep discharge, and prioritize mobility needs. Under those controlled conditions, the relevant question is not whether any incremental degradation occurs, but whether it is material or economically meaningful.

What the Evidence Tells Us So Far

Recent laboratory and field studies increasingly point in a consistent direction. When bidirectional charging emphasizes shallow cycling, avoids prolonged high state-of-charge exposure, and limits aggressive power rates, degradation does not appear dramatically different from well-managed conventional charging.

Some studies suggest that keeping batteries away from persistently high SOC levels can even reduce calendar-related stress. Experimental work applying real-world V2G load profiles to commercial cells has found that differences between charging strategies are sometimes comparable to normal manufacturing variation.

This does not mean all V2G is benign. Aggressive dispatch, high C-rates, or deep cycling layered onto heavy fast-charging use can accelerate wear. But those outcomes reflect design choices, not inherent properties of bidirectional charging.

The emerging conclusion is straightforward: how V2G is implemented matters more than the fact that it is implemented.

The OEM and Warranty Gap

If the technical case is becoming clearer, why does battery health remain a barrier?

Much of the hesitation lies in warranty frameworks. Most EV warranties were written for a one-way charging world. They assume charging, propulsion discharge, and occasional fast charging, not systematic export to buildings or the grid.

Automakers therefore face a balancing act: protecting against long-term liability while responding to growing demand for bidirectional capability from utilities, regulators, and customers.

Today, the result is fragmentation. Some automakers, such as Ford, explicitly support bidirectional charging but limit approved use cases to home backup with designated hardware. Others, like Nissan, have enabled V2G in specific pilot programs or regions but within defined technical and programmatic boundaries. Still others remain silent on warranty treatment or exclude export entirely. The result is a patchwork of capabilities, permissions, and uncertainty that slows broader market development.

Bridging this gap will require clearer operating envelopes, improved data sharing, and updated warranty structures that reflect real-world usage patterns. The technical evidence is advancing, but policy alignment has lagged behind.

The Role of Software and Control

One underappreciated lesson from recent research is the outsized role of software. Battery health under V2G is less about chemistry alone and more about control strategies.

Advanced energy management platforms can optimize around battery constraints in real time, adjusting power levels, limiting depth of discharge, responding to temperature conditions, and coordinating with mobility needs. These systems turn V2G from a blunt instrument into a precision tool.

As V2G programs mature, expect greater emphasis on battery-aware dispatch, dynamic limits, and performance-based participation rather than fixed schedules. This evolution mirrors what we’ve seen in stationary storage, where software has become just as important as hardware in managing degradation and system value.

Looking Ahead: Why Battery Technology Changes the Equation

Even as today’s lithium-ion batteries continue to prove more resilient under well-managed V2G operation than once feared, the next wave of battery technology is beginning to take shape, and it has the potential to materially change how battery health is viewed in bidirectional applications.

Solid-state batteries and other advanced chemistries promise higher energy density, improved safety, and, most relevant for V2G, far greater tolerance for cycling and wider operating windows. By replacing liquid electrolytes with solid materials, these designs aim to reduce several of the degradation pathways that constrain conventional lithium-ion cells, particularly those associated with repeated charge-discharge cycling and elevated temperatures.

Several established players have been pursuing this trajectory for years. Toyota has publicly reiterated its intent to commercialize solid-state EV batteries in the second half of the decade, emphasizing durability, fast-charging capability, and longer usable life. In parallel, QuantumScape and Solid Power continue to advance lithium-metal solid-state designs explicitly positioned to improve cycle life under demanding duty cycles, including high-utilization fleet use.

More recently, two developments have pushed solid-state batteries back into the headlines, though in very different ways.

At CES 2026, Donut Lab, a Finland-based startup, made eye-catching claims about a commercial solid-state battery already shipping in electric motorcycles. The company has asserted performance metrics that, if validated, would far exceed today’s lithium-ion batteries, including extremely fast charging and extraordinary cycle life. Those claims have been met with significant skepticism from battery researchers and industry analysts, who note the lack of independent testing, limited disclosure of chemistry or manufacturing processes, and unresolved questions about whether the technology is a true battery, a capacitor-based system, or something in between. For now, Donut Lab’s announcement serves as a reminder that not all “solid-state” claims are created equal, and that proof, not press releases, ultimately determines impact.

In contrast, ProLogium represents a more conventional, and arguably more consequential, signal that solid-state technology is moving out of the lab. In early 2024, ProLogium opened what it describes as the world’s first giga-scale solid-state lithium ceramic battery factory in Taiwan, with planned production capacity of 2 GWh and strategic partnerships involving major automotive and materials firms. The company has reported shipping thousands of solid-state battery samples to global automakers and claims that its manufacturing processes have achieved yields and cost trajectories approaching those of mainstream lithium-ion cells, a long-standing hurdle for solid-state commercialization.

While timelines should still be treated cautiously, these developments make a medium-term horizon, on the order of the next five years, look increasingly plausible for early commercial deployments, particularly in premium vehicles and fleet applications. Even limited adoption in these segments could meaningfully shift OEM attitudes toward bidirectional charging by reducing perceived battery-life risk and expanding the operational envelope for V2G services.

Crucially, these advances do not need to eliminate battery degradation to matter. They simply need to reduce it to the point where bidirectional cycling becomes operationally and economically insignificant relative to the overall life of the vehicle. If that threshold is crossed, battery health may cease to be the dominant constraint on V2G and instead become just another parameter managed through software, warranties, and program design.

Reframing the Question

The conversation around V2G is evolving. The relevant question is no longer, “Does V2G degrade batteries?” All cycling does. The more useful question is: under what conditions does V2G create more value than wear?

For many use cases, fleets with long dwell times, residential participation in limited demand response events, vehicles operating within controlled SOC bands, the answer is increasingly favorable.

Battery health should continue to be studied and managed transparently. But it no longer justifies indefinite delay. As evidence accumulates and battery technology advances, the bottleneck for V2G is shifting away from chemistry and toward institutional readiness: regulatory frameworks, compensation mechanisms, interconnection pathways, and warranty alignment.

V2G has always been about system integration. Battery health remains part of that equation, but it is increasingly a solvable one. The larger challenge now is ensuring that policy and market structures are prepared to scale alongside the technology.