As bidirectional charging moves from pilot projects toward early commercialization, the conversation around vehicle-to-grid (V2G) is increasingly shaped by industry-authored white papers. These documents play an important role: they help organize technical concepts, clarify emerging standards, and articulate how V2G could integrate into energy markets at scale. At the same time, they inevitably reflect the perspectives and commercial interests of their authors.

A recent white paper, Fundamentals and Applications of Bi-Directional Charging, authored by Sigenergy and The Mobility House, offers a useful case study in how the industry currently understands V2G, its promise, its architecture, and its remaining barriers. Read carefully, the report provides valuable orientation for policymakers and practitioners from a global perspective. Read uncritically, however, it risks overstating readiness and understating the unresolved questions that continue to constrain scale.

This article reviews the report as industry intelligence: not as definitive proof of V2G value, but as a window into how leading technology and aggregation firms believe bidirectional charging should evolve, and what must still change for that vision to materialize.

Clarifying the V2X Landscape: A Strength of the Report

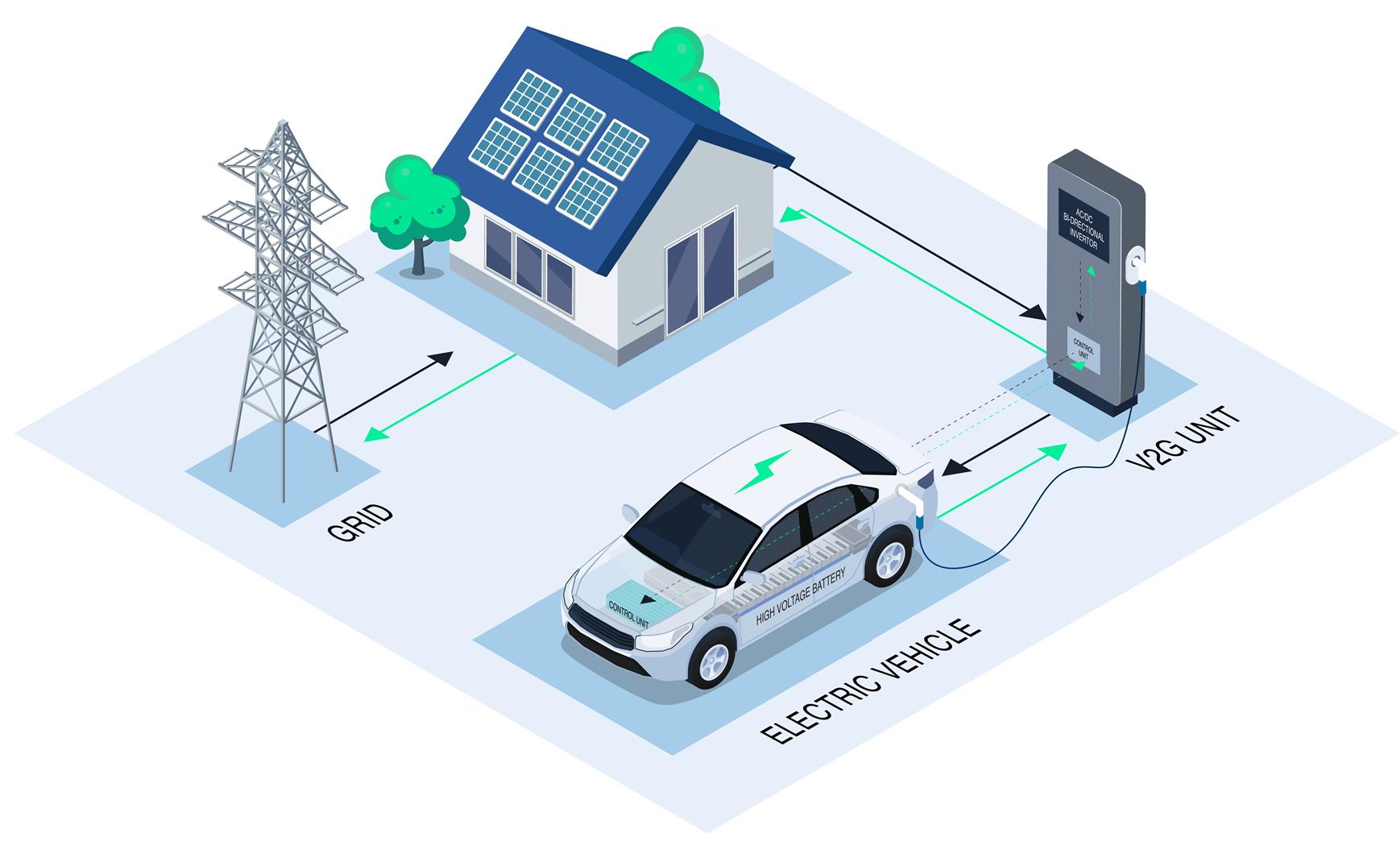

One of the paper’s strongest contributions is its clear taxonomy of bidirectional charging modes and use cases. The authors distinguish between three fundamental operating conditions: islanded operation for backup power, grid-connected non-export operation, and grid-connected operation with export to the grid. This distinction matters because it cuts directly to a recurring source of confusion in V2G discourse.

Much of today’s deployed bidirectional hardware, particularly in residential settings, operates either in islanded mode or in non-export configurations. These applications deliver real value in the form of resilience, self-consumption optimization, and peak shaving behind the meter. However, as discussed in this edition’s V2G Insights article, these use cases stop short of unlocking the full grid-facing potential of EVs. The report is refreshingly explicit on this point. Only when EVs are allowed to export power in parallel with the grid do they become dispatchable assets capable of providing demand response, wholesale market services, or flexibility through virtual power plants.

The paper also provides a useful breakdown of V2H, V2B, V2G, and V2L/V2V use cases, mapping them to customer types and control schemes. For readers new to the space, or policymakers trying to sort through overloaded terminology, this clarity is genuinely helpful.

Standards and Interoperability: A Candid Assessment

The report is equally strong in its treatment of standards, grid codes, and interoperability. It walks through the fragmented landscape of regional interconnection requirements, UL 1741 in North America, EN 50549 and VDE-AR-N 4105 in Europe, AS/NZS 4777.2 in Australia, and correctly situates V2G as a form of distributed energy resource subject to the same grid protection and power quality expectations as PV and stationary storage

The discussion of communications standards is particularly relevant. While ISO 15118-20 is widely viewed as the long-term foundation for bidirectional power transfer, the report acknowledges that testing protocols, certification pathways, and broad OEM adoption are progressing more slowly than anticipated. Proprietary implementations and partial solutions remain common, limiting interoperability and slowing market formation.

Importantly, the authors do not gloss over these issues. They explicitly identify interoperability as a blocking constraint on scale and recognize that the current ecosystem requires market-specific product variants and bespoke integration. This realism strengthens the report’s credibility and reinforces a key insight for regulators: standardization is not an abstract technical goal, it is a precondition for competitive markets and customer participation.

Where the Paper Becomes Aspirational

The authors argue that V2G can unlock substantial revenue for EV owners through energy arbitrage, frequency regulation, and aggregation into wholesale and balancing markets. They point to increasing periods of negative wholesale prices in Europe as evidence that bidirectional flexibility will become more valuable over time.

Conceptually, this argument is sound. In systems with high renewable penetration, flexible demand and storage are increasingly valuable. Aggregation is essential, given the small size and stochastic availability of individual EVs. And dynamic tariffs are a necessary link between wholesale market signals and customer behavior.

What the paper does not provide, however, is empirical evidence that these value streams are durable, bankable, or sufficient to support large-scale private investment today. Revenue estimates remain qualitative. Distribution system impacts are discussed in general terms rather than quantified. Battery degradation is acknowledged as a concern, but not rigorously modeled against expected earnings.

This does not make the analysis wrong, but it does place it squarely in the realm of expected value rather than demonstrated value. That distinction matters, particularly for regulators tasked with approving tariffs, incentives, or cost recovery mechanisms.

What This Report Signals for Policymakers

Read as industry intelligence, the paper sends three clear signals.

First, the technology stack for bidirectional charging is maturing faster than the institutional frameworks that govern it. Standards exist, but adoption is uneven. Hardware is capable, but permissions are limited. Software platforms are sophisticated, but markets remain inaccessible in many jurisdictions.

Second, export-enabled V2G is inseparable from market design. Without tariffs that accommodate bidirectional flows, interconnection rules that allow parallel operation, and aggregation pathways that reduce transaction costs, V2G will remain confined to pilots and niche deployments.

Third, optimism alone will not close the gap. Moving from promise to scale will require evidence-based policy, grounded in real-world data on customer behavior, battery impacts, grid benefits, and cost effectiveness relative to alternatives like managed charging.

Conclusion: Useful, but Not the Final Word

It is also important to recognize what the report is, and is not. Later sections move into detailed descriptions of Sigenergy’s DC-coupled architecture, integration with PV and stationary storage, and claimed advantages over alternative V2G configurations. These sections are effectively product narratives, and they should be read as such.

For V2G News readers, this is not a flaw so long as it is clearly contextualized. Industry white papers are valuable precisely because they reveal how vendors and aggregators are designing systems to navigate today’s regulatory constraints. They show where companies are placing bets, on DC architectures, on aggregation platforms, on tariff innovation, and where they see friction.

Fundamentals and Applications of Bi-Directional Charging is a worthwhile report for anyone seeking to understand how the V2G industry currently conceptualizes its future. It succeeds as a technical primer and as a statement of intent from two experienced market participants. It also candidly acknowledges many of the barriers that continue to slow progress.

What it does not, and cannot, do is resolve the central question now facing V2G: under what conditions does bidirectional charging deliver incremental, system-level value that justifies durable compensation and regulatory support?

Answering that question will require moving beyond white papers toward transparent data, independent analysis, and regulatory experiments that test V2G under real operating constraints. Until then, reports like this are best read not as verdicts, but as signals, useful guides to where the industry wants to go, and reminders of how far it still has to travel.